Altcoin Mining Explained: Profitability and Pitfalls

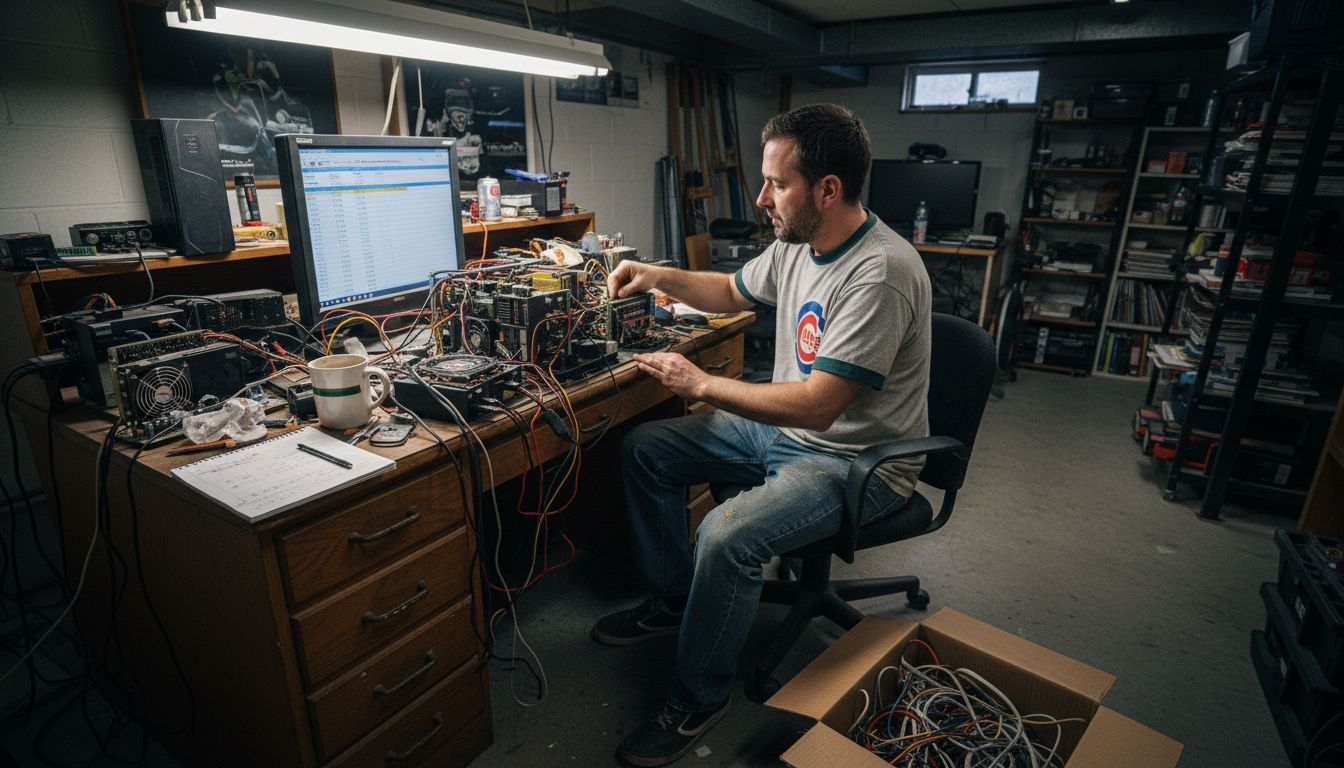

Starting an altcoin mining journey often reveals more questions than answers for American investors. Every cryptocurrency network brings its own challenges, from hardware selection to unpredictable running costs that can make or break your returns. This overview clarifies key hardware types, emphasizes the impact of electricity prices, and addresses common myths so you can confidently compare performance, costs, and long-term profitability before deciding where to invest.

Defining Altcoin Mining and Common Myths

Altcoin mining represents the process of validating transactions and creating new cryptocurrency units for non-Bitcoin digital currencies. Unlike Bitcoin mining, this approach involves using specialized computational power to solve complex mathematical problems across diverse blockchain networks.

Specifically, altcoin mining encompasses several critical characteristics:

- Utilizes different Proof-of-Work (PoW) algorithms unique to each cryptocurrency

- Requires specific hardware configurations like ASICs, GPUs, or CPUs

- Generates rewards through transaction verification and network security

- Varies dramatically in profitability based on individual coin economics

Cryptocurrency networks like Litecoin, Dogecoin, and Monero represent prime examples of altcoin mining opportunities. Each network demands unique computational approaches, making hardware selection a nuanced decision for potential miners.

Key Misconceptions surrounding altcoin mining frequently mislead newcomers. Many assume mining is a guaranteed profit stream, when in reality, success depends on multiple volatile factors:

- Electricity costs in your geographic region

- Current market prices for specific cryptocurrencies

- Network mining difficulty

- Hardware efficiency and depreciation rates

Not all altcoins are equally mineable or profitable – research is crucial before investing in mining equipment.

Pro tip: Always calculate your potential electricity expenses and projected hardware performance before committing to any altcoin mining venture.

Main Types of Altcoin Mining Hardware

Altcoin mining hardware represents a diverse ecosystem of computational technologies designed to validate transactions and generate cryptocurrency rewards. Hardware selection critically impacts mining profitability across various blockchain networks, with each technology offering unique advantages and limitations.

The primary types of altcoin mining hardware include:

- GPUs (Graphics Processing Units): Versatile hardware capable of mining multiple cryptocurrencies

- CPUs (Central Processing Units): Entry-level mining option with limited efficiency

- ASICs (Application-Specific Integrated Circuits): Specialized hardware optimized for specific cryptocurrency algorithms

- Helium Miners: Unique network-based hardware generating rewards through network coverage

GPU Mining remains popular due to its flexibility and potential for switching between different cryptocurrencies. These devices excel at handling complex computational tasks across various blockchain networks, making them attractive for miners seeking adaptability.

ASIC miners represent the pinnacle of mining efficiency, delivering maximum hash rates for specific cryptocurrencies like Litecoin and Dogecoin. However, their algorithm-specific design means they become obsolete quickly when network requirements change.

Successful altcoin mining requires understanding the nuanced trade-offs between hardware performance, power consumption, and initial investment costs.

CPU mining offers the lowest barrier to entry but provides minimal returns compared to more specialized hardware. Some privacy-focused cryptocurrencies like Monero still support CPU mining, providing opportunities for beginners.

Here’s a concise comparison of the main types of altcoin mining hardware:

| Hardware Type | Typical Use Case | Flexibility | Efficiency Focus |

|---|---|---|---|

| GPU | Multi-coin mining | Very high | Balances speed and adaptability |

| ASIC | Single-algorithm mining | Very low | Maximum speed for select coins |

| CPU | Learning and small-scale mining | High | Minimal for most coins |

| Helium Miner | Network coverage rewards | Low | Location-based returns |

Pro tip: Carefully analyze your electricity costs, hardware efficiency, and target cryptocurrency’s mining algorithm before investing in any mining equipment.

How Altcoin Mining Works and Key Algorithms

Altcoin mining is a complex computational process where miners validate blockchain transactions through solving intricate cryptographic challenges. Crypto mining algorithms fundamentally determine network security by establishing rules for transaction verification and reward distribution.

The primary mining algorithms used in altcoin networks include:

- SHA-256: Used by Bitcoin and several Bitcoin-like cryptocurrencies

- Scrypt: Popular for Litecoin and Dogecoin mining

- RandomX: Designed for CPU-friendly mining, primarily used by Monero

- KawPow: Optimized for GPU mining on networks like Ravencoin

- kHeavyHash: Specialized algorithm for Kaspa network

Proof-of-Work Mechanism represents the core operational principle behind these algorithms. Miners compete to solve complex mathematical puzzles by running computational calculations through specialized hardware. The first miner to solve the puzzle gets the opportunity to add a new block to the blockchain and receive cryptocurrency rewards.

Each algorithm introduces unique challenges and requirements. For instance, RandomX prioritizes CPU accessibility, while SHA-256 demands high-performance ASIC hardware. This algorithmic diversity ensures network decentralization and prevents monopolistic mining practices.

Successful miners must understand the specific algorithm requirements for their target cryptocurrency to optimize hardware selection and mining efficiency.

The computational complexity of mining algorithms dynamically adjusts to maintain consistent block generation times and network security. This mechanism, known as difficulty adjustment, ensures that mining remains competitive and prevents rapid coin inflation.

Pro tip: Research the specific mining algorithm of your target cryptocurrency and match your hardware capabilities precisely to maximize potential mining returns.

Essential Costs, Operating Risks, and Return

Altcoin mining involves complex financial considerations that extend far beyond initial hardware investments. Mining costs encompass multiple critical expense categories that can dramatically impact overall profitability and long-term sustainability.

Key cost components for altcoin mining include:

- Hardware Acquisition: Initial investment in mining equipment

- Electricity Consumption: Ongoing operational power expenses

- Cooling and Maintenance: Infrastructure and equipment preservation costs

- Network Fees: Potential transaction and blockchain-related expenses

- Replacement and Depreciation: Long-term hardware value reduction

Electricity Expenses represent the most significant ongoing cost for miners, typically consuming 75-85% of operational budgets. Geographic location plays a crucial role, with electricity rates varying dramatically between regions and directly impacting mining profitability.

Operational risks in altcoin mining are substantial and multifaceted. Market volatility, sudden changes in mining difficulty, hardware obsolescence, and unpredictable cryptocurrency valuations can quickly transform a potentially profitable venture into a financial challenge.

Successful miners must consistently reassess their operational strategies, adapting to rapidly changing technological and market conditions.

Effective risk mitigation involves diversifying mining approaches, maintaining flexible hardware configurations, and continuously monitoring network economics. Miners should develop comprehensive strategies that account for potential market fluctuations and technological advancements.

To better understand mining profitability, review these key costs and risk factors:

| Cost/Risk Factor | Impact on Returns | How to Manage |

|---|---|---|

| Electricity Expenses | Directly reduces profits | Locate low-rate regions |

| Hardware Depreciation | Lowers long-term gains | Plan for upgrades/timing |

| Market Volatility | Rapid profit swings | Monitor and diversify |

| Difficulty Changes | Affects reward rates | Adapt hardware/software |

Pro tip: Calculate your total cost per kilowatt-hour and projected hardware efficiency before committing to any long-term mining investment.

Avoiding Mistakes and Maximizing Profits

Successful altcoin mining requires strategic planning and a comprehensive understanding of potential pitfalls. Common mining mistakes can dramatically impact overall profitability, making careful research and preparation essential for sustainable returns.

Critical mistakes miners must avoid include:

- Selecting hardware incompatible with specific cryptocurrency algorithms

- Underestimating electricity consumption and operational costs

- Failing to join effective mining pools

- Neglecting regular hardware maintenance

- Ignoring network difficulty fluctuations

Hardware Selection represents the foundational decision in mining strategy. ASICs offer high computational efficiency but limited flexibility, while GPUs provide greater adaptability across different cryptocurrency networks. Miners must carefully evaluate their hardware choices based on specific algorithmic requirements and long-term performance potential.

Maintaining realistic expectations is crucial in the volatile cryptocurrency mining landscape. Network difficulty increases, market price fluctuations, and technological advancements can rapidly transform mining profitability. Successful miners continuously adapt their strategies, monitor operational costs, and remain flexible in their approach.

Profitability in altcoin mining is not guaranteed – it requires constant learning, adaptation, and strategic investment.

Effective risk management involves diversifying mining strategies, maintaining robust cooling systems, and developing comprehensive operational contingency plans. Miners should invest time in understanding network economics, algorithm specifics, and emerging technological trends.

Pro tip: Calculate your break-even point and potential ROI using conservative estimates, accounting for potential market and technological changes.

Unlock Real Altcoin Mining Potential with Trusted Hardware Solutions

Navigating the complex world of altcoin mining requires more than just understanding algorithms and electricity costs. If you want to avoid costly mistakes and maximize profitability this is where smart hardware choices and expert guidance matter most. ING Mining specializes in sourcing and thoroughly testing ASIC miners to help miners like you overcome challenges such as hardware obsolescence, power efficiency concerns, and fluctuating market conditions.

Explore reliable, professionally inspected mining equipment and get hands-on advice tailored to your goals. Stop guessing about your break-even points and start mining with confidence. Visit ING Mining today to discover how you can select the right miner, optimize operational costs, and scale your altcoin mining operation the smart way. Don’t wait as market volatility and increasing mining difficulty demand quick and informed action.

Get your optimized mining setup now at https://ingmining.com/ and turn your altcoin mining strategy into lasting success.

Frequently Asked Questions

What is altcoin mining?

Altcoin mining is the process of validating transactions and creating new units of non-Bitcoin cryptocurrencies by solving complex mathematical problems across various blockchain networks.

How does hardware selection impact altcoin mining profitability?

The choice of hardware, such as GPUs, CPUs, or ASICs, plays a crucial role in determining the efficiency and profitability of mining. Each type has unique strengths and weaknesses, and the right selection can significantly affect returns.

What are the key factors that influence the profitability of altcoin mining?

Profitability is influenced by several factors, including electricity costs, current cryptocurrency market prices, mining difficulty, and the efficiency of the mining hardware used.

What common mistakes should I avoid when starting altcoin mining?

Some critical mistakes include selecting incompatible hardware, underestimating electricity costs, neglecting regular maintenance, and failing to join effective mining pools, which can all negatively impact overall profitability.